- Empire

- Posts

- 🤝 Within reach

🤝 Within reach

MicroStrategy's role in bitcoin's road to $100k

Brought to you by:

🧱 Over the wall

$100,000 is just out of reach right now.

We saw some resistance on Friday as bitcoin touched $99.8k before backing down, which isn’t really a surprise when you look at how much bitcoin could be sold just on Coinbase once we hit the elusive record.

1,000 BTC for Sale on Coinbase at $100k

— matthew sigel, recovering CFA (@matthew_sigel)

7:38 PM • Nov 22, 2024

In an X post, Galaxy’s Michael Novogratz said this amounts to “normal profit taking” as Alex Thorn’s data shows that a lot of the sellers came in this year above $56,000, and are looking to offload.

Galaxy Research @intangiblecoins telling me that most of the selling is coming from 2024 buyers who bought above 56k.. normal profit taking...

I still think new buyers are gonna HODL and eating through supply is long term healthy.

— Mike Novogratz (@novogratz)

11:13 PM • Nov 24, 2024

Despite this being a holiday week for folks in the US (which, on the Wall Street side of things, generally means that volumes are slightly lower), there may be a reason to be bullish on hitting $100k.

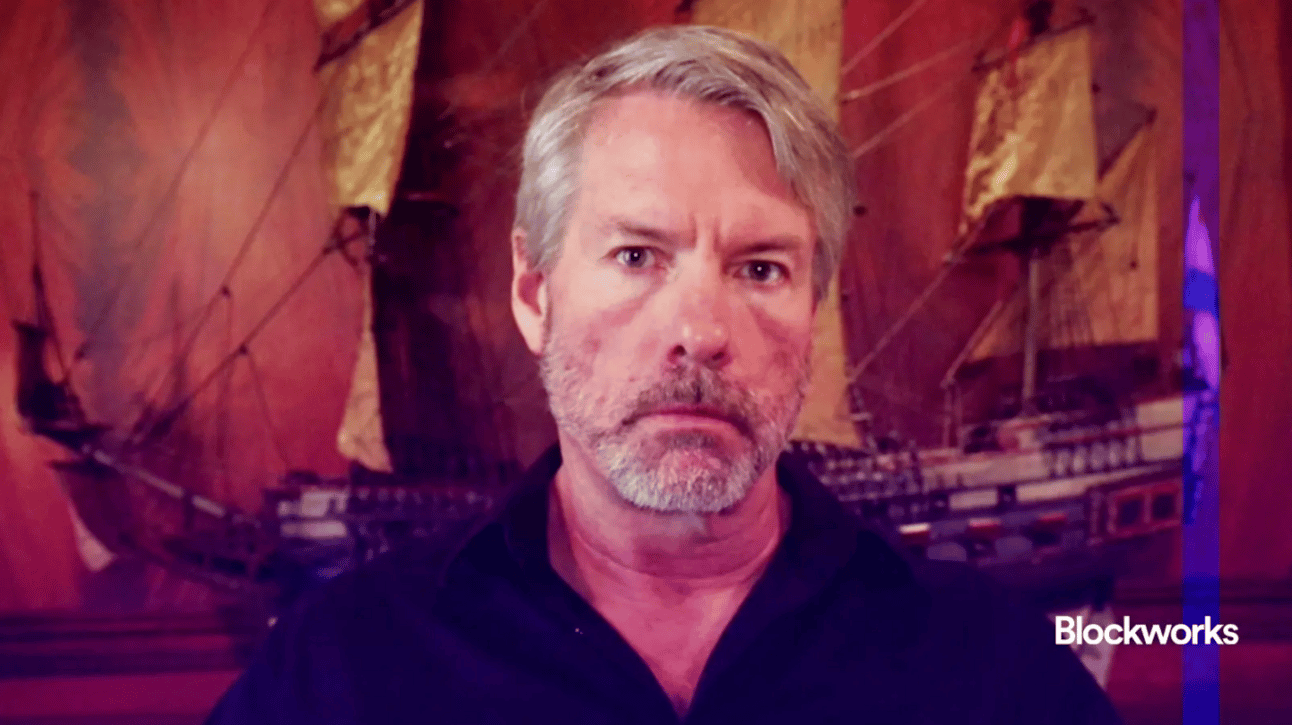

And, to no one’s surprise, all roads lead back to MicroStrategy. The firm, in an SEC filing this morning, announced that it purchased 55,500 bitcoin — worth $5.4 billion — at the end of last week into the weekend at an average price of nearly $98,000 per bitcoin.

The filing was expected, given that we knew a big purchase was on the horizon after it announced at the end of last week that it closed its bond offering. And that came after it was upsized to nearly $3 billion from an initial $1.75 billion.

The most recent purchase comes on the heels of a $4.6 billion buy earlier this month. That means — if you’re looking at the math — we’ve seen Saylor’s company buy up $10 billion worth of bitcoin this month alone. Wild, right?

While Saylor’s purchases are catalysts for price action, it’s not looking like it’s enough to send us over $100k just yet, but perhaps it’ll help folks breach the wall that’s currently in place.

After all, there’s one other trend that shows we could break $100,000 sooner rather than later. According to FalconX’s David Lawant, there have been a few notable liquidity shifts in the market.

Source: FalconX

“BTC reached its highest spot volume print ever on a seven-day moving average basis and for the first time since 2021 is in shooting range of doing the same on the futures side. While spot volumes on the week after the election brought the daily traded value to above $40 billion, over the past week it was slightly lower at $25-35 billion but still two to three times the levels we have been seeing between March 2024 and the election,” Lawant wrote.

However, the volume jump hasn’t led to an increase in book order depth, which would together lead to a “stronger” impact on price action.

Source: FalconX

Essentially, this data shows that $100,000 remains a tough level to break through, but “the overall picture remains encouraging,” according to Lawant.

— Katherine Ross

P.S. Can you do us a favor? Help us tailor Empire to best fit your interests. Fill out this survey.

Brought to you by:

Today’s sponsor is Bitkey, a hardware wallet for bitcoin created by the team behind Square and Cash App.

Effortless Security: Bitkey makes managing your bitcoin absurdly simple with a secure and easy-to-use setup.

Integration with Top Platforms: Connect with partners like Cash App, Coinbase, Robinhood, and Blockchain.com to easily compare prices before buying or selling.

Familiar and Intuitive App: The Bitkey app works like popular money apps, making sending, receiving, and tracking bitcoin value seamless.

Award-Winning Innovation: Recognized as one of TIME’s Best Inventions of 2024, Bitkey simplifies self-custody with a three-key approach, eliminating the need for complicated seed phrases.

Perfect Gift for Bitcoin Enthusiasts: Simplify self-custody for yourself or a bitcoin-loving friend.

For a limited time, get Bitkey for just $99 (save $51). Available on Amazon, Best Buy, or bitkey.world.

A new venture fund is entering the mix after Two Sigma veterans raised $25 million for a crypto-focused venture fund, Fortune reported.

CoinShares noted that crypto investment products saw inflows of $3.13 billion last week — the largest weekly inflows on record.

Startup bank Singapore Gulf Bank is looking to raise funds to buy a stablecoin payments company next year.

Howard Lutnick’s Cantor Fitzgerald is working with Tether on a potential $2 billion bitcoin lending project, Bloomberg reported.

Sky Mavis, the firm behind Axie Infinity, laid off 21% of its workforce.

Q: Will Thanksgiving dampen price action?

Honestly, I’m not sure.

I’m leaning toward no, given that — as I wrote above — folks want to see bitcoin break $100k. I’ve gotten some mixed responses on whether or not we can stay above $100k once we get through that level (and it’s something we’ll probably chat about later this week), but there’s no doubt that there’s an appetite whether it's profit-taking or buying.

Maybe Thanksgiving itself is enough to keep crypto soaring. I imagine it’ll be a fun topic around the turkey table. If people get enough parents and grandparents to buy up bitcoin, we may not even need Saylor.

I’m kidding… kind of. But it will be interesting to see what happens. Crypto’s full of surprises.

— Katherine Ross